Investment Highlights

Niche-Targeted

Strategy

Within close proximity of Downtown Miami, Brickell, and South Beach, developing the Little Havana neighborhood, as well as select urban clusters nearby will allow us to capitalize on increased rental demand in these growing sub-markets.

Accomplished Management Team

Our group has extensive experience in acquiring, developing and managing multi-family rental properties in South Florida.

Anticipating Growth

Several projects near Downtown Miami and the Port of Miami are expected to positively impact the job market and attract more residents to the area.

Investment Return on Capital

Targeted 10% cash-on-cash return and an IRR between 15% and 20%.

Local Government Support

City officials have implanted zoning laws to accommodate and facilitate the housing needs of this sub-market.

Within close proximity of Downtown Miami, Brickell, and South Beach, developing the Little Havana neighborhood, as well as select urban clusters nearby will allow us to capitalize on increased rental demand in these growing sub-markets.

Accomplished Management Team

Our group has extensive experience in acquiring, developing and managing multi-family rental properties in South Florida.

Anticipating Growth

Several projects near Downtown Miami and the Port of Miami are expected to positively impact the job market and attract more residents to the area.

Investment Return on Capital

Targeted 10% cash-on-cash return and an IRR between 15% and 20%.

Local Government Support

City officials have implanted zoning laws to accommodate and facilitate the housing needs of this sub-market.

Investment Strategy

|

Acquisition Criteria

|

Niche-Targeted MarketsThe neighborhoods of Little Havana, Hialeah, Sweetwater, Westchester, and select urban clusters in the greater City of Miami are located within miles of Downtown Miami, South Beach, and the Miami International Airport. With several development projects underway in Downtown Miami, Brickell, and the Port of Miami, jobs are increasingly becoming available to middle-class and middle-market professionals who, in turn, are looking for affordable housing nearby.

|

Target Markets:

|

Mismanaged Properties

|

|

High-Demand Middle-Income Renter

(Targeted $30,000 to $50,000 range)

|

|

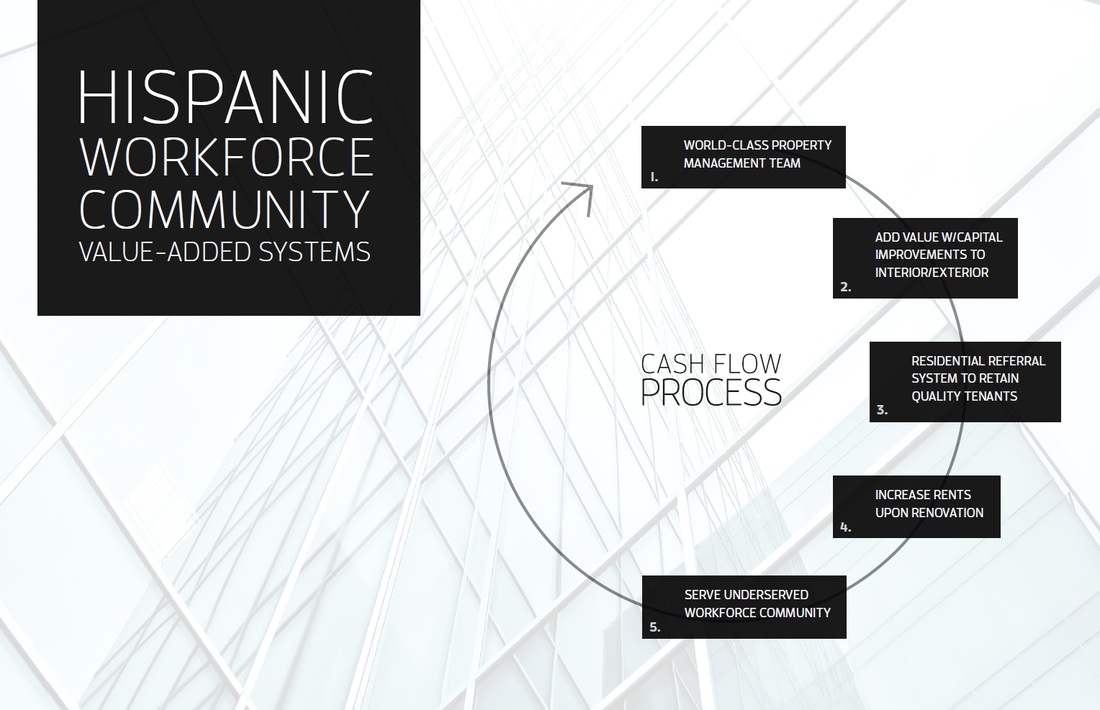

Hispanic Workforce Community Value-Added Systems

Cash Flow Process

- World-Class Property Management Team

- Add Value w/Capital Improvements to Interior/Exterior

- Residential Referral System to Retain Quality Tenants

- Increase Rents Upon Renovation

- Serve Underserved Workforce Community

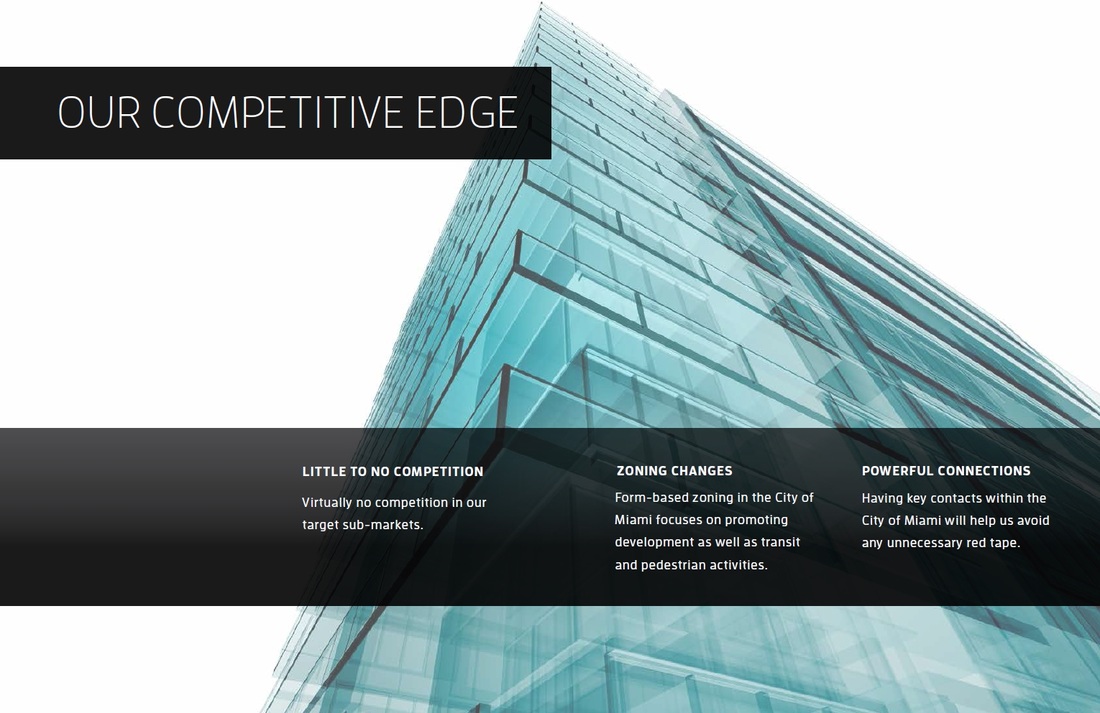

Our Competitive Edge

|

Little to No Competition

Virtually no competition in our target sub-markets. |

Zoning Changes

Form-based zoning in the City of Miami focuses on promoting development as well as transit and pedestrian activities. |

Powerful Connections

Having key contacts within the City of Miami will help us avoid any unnecessary red tape. |

Keys to Success

|

Talent

With seasoned developers, builders, commercial real estate brokers and a legal team with vast experience in this market niche, our team’s mission is to expertly reposition and add value to multi-family sites within select urban clusters in the Greater City of Miami. |

Location

Brickell CitiCentre, a $1.06 billion high-end, mix-use retail center within close proximity of our target urban clusters, is estimated to create approximately 1,700 construction-related jobs per year for the next four years and approximately 3,800 permanent jobs upon its completion. In addition, the Port of Miami currently has three projects underway to prepare for the completion of the Panama Canal expansion in 2015. These and related projects are expected to generate over 100,000 jobs in Florida. The Port of Miami is just miles East of our target markets. |

Demand

Our target sub-markets are ideally positioned to provide rental housing to middle-class families and young urban professionals that cannot afford to live in the areas in which they work, such as Downtown Miami and Brickell.

The Brickell-Downtown sector is high-end and the price to rent is steadily rising. With all of the highly anticipated commercial development and job growth in this sector, repositioning and adding value to multi-family properties in these sub-markets makes perfectly sound economic sense.

Our target sub-markets are ideally positioned to provide rental housing to middle-class families and young urban professionals that cannot afford to live in the areas in which they work, such as Downtown Miami and Brickell.

The Brickell-Downtown sector is high-end and the price to rent is steadily rising. With all of the highly anticipated commercial development and job growth in this sector, repositioning and adding value to multi-family properties in these sub-markets makes perfectly sound economic sense.

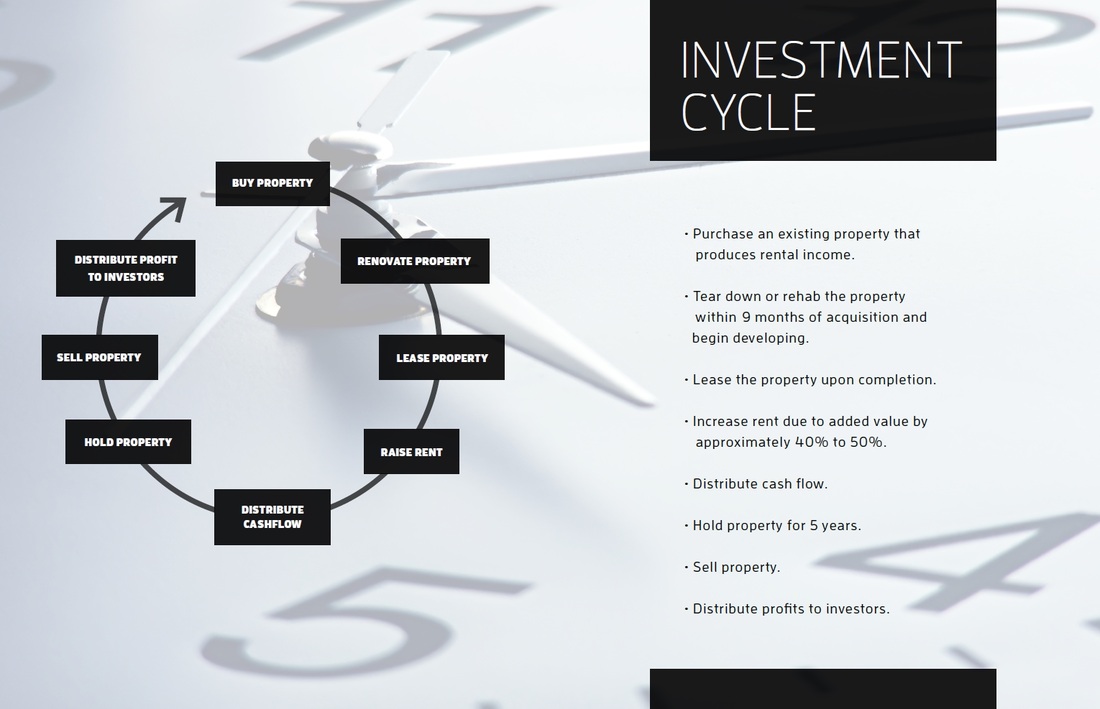

Investment Cycle

- Buy Property. Purchase an existing property that produces rental income.

- Renovate Property. Tear down or rehab the property within 9 months of acquisition.

- Lease Property. Lease the property upon completion.

- Raise Rent. Increase rent due to added value by approximately 40% to 50%.

- Distribute Cash Flow. Distribute cash flow.

- Hold Property. Hold property for 5 years.

- Sell Property. Sell property.

- Distribute Profit to Investors. Distribute profit to investors.

Partnering with Esquire Capital Investments

Esquire Capital Investments, LLC is a fully integrated, privately held commercial real estate investment firm specializing in developing multi-family housing in our target sub-markets of Miami, Florida. We are currently seeking accredited investors to acquire income-producing commercial real estate properties in Hialeah, Little Havana, Sweetwater, Westchester and select Miami neighborhoods.

Esquire Capital is committed to excellence across all phases of the investment cycle and to the highest level of professionalism and transparency to its investors. Our strategy is opportunistic and effective: upgrade existing multi-family properties that will cater to high demand from an underserved segment of the population and produce consistent investment returns of at least 15% for its investors.

As an investor, partnering with Esquire Capital gives you the opportunity to add another source of income to your portfolio, one that can generate substantial passive income for years to come.

Esquire Capital Investments, LLC is a fully integrated, privately held commercial real estate investment firm specializing in developing multi-family housing in our target sub-markets of Miami, Florida. We are currently seeking accredited investors to acquire income-producing commercial real estate properties in Hialeah, Little Havana, Sweetwater, Westchester and select Miami neighborhoods.

Esquire Capital is committed to excellence across all phases of the investment cycle and to the highest level of professionalism and transparency to its investors. Our strategy is opportunistic and effective: upgrade existing multi-family properties that will cater to high demand from an underserved segment of the population and produce consistent investment returns of at least 15% for its investors.

As an investor, partnering with Esquire Capital gives you the opportunity to add another source of income to your portfolio, one that can generate substantial passive income for years to come.